“Physicswallah IPO: ₹3,480 Crore Launch on Nov 11”!

- ByBhawana ojha

- 05 Nov, 2025

- 0 Comments

- 2

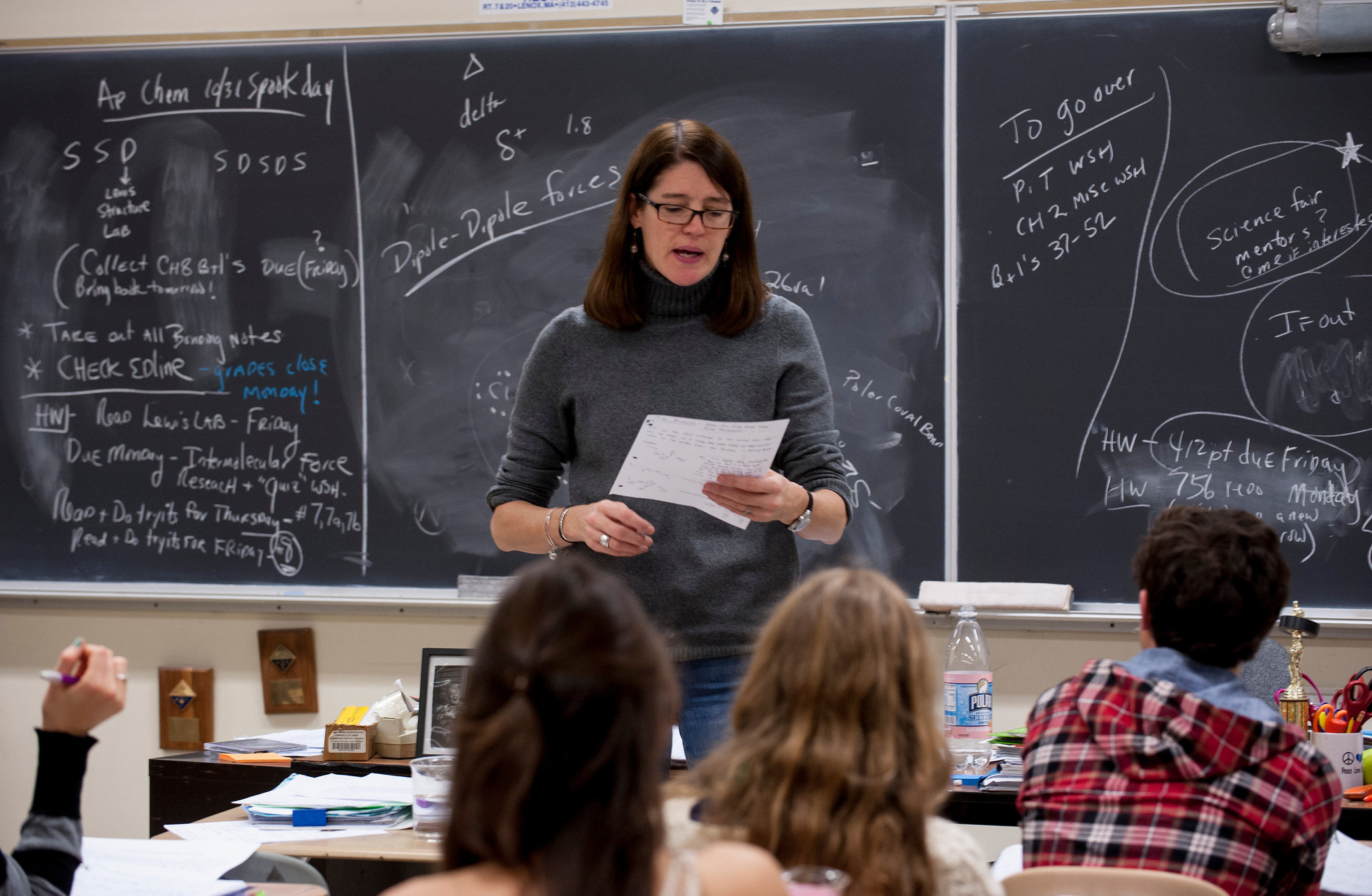

Online education platform Physicswallah has filed for an initial public offering (IPO) of ₹3,480 crore, scheduled to hit Dalal Street on 11 November 2025. The raise comprises ₹3,100 crore worth of fresh issue of equity shares and ₹380 crore via offer-for-sale by promoters Alakh Pandey and Prateek Boob.

Founded in 2020, Physicswallah offers test-preparation courses for competitive exams like JEE, NEET and UPSC, blending online and increasingly hybrid/offline models. According to its latest regulatory filing, the company posted revenue of ₹2,886.6 crore in FY 2025, up ~48.7% from the prior year, though it recorded a loss of ₹225.8 crore.

The IPO proceeds are earmarked for multiple purposes: expansion of offline and hybrid learning centres (₹460.5 crore), lease payments (₹548.3 crore + ₹28 crore), investment in its subsidiary and technology infrastructure (₹200.1 crore), marketing (₹710 crore) and inorganic growth With support from investors such as WestBridge Capital, Hornbill Capital and GSV Ventures, the company is positioning itself as one of India’s key ed-tech players making the transition from startup to listed entity.

For investors, the listing poses an interesting proposition: a fast-growing revenue base in the booming Indian education market, balanced by the path to sustained profitability and competition in the ed-tech space.

Tags:

Post a comment

Strong Q2 GDP Boosts India’s Market Optimism!

- 28 Nov, 2025

- 2

India’s ₹148 Trillion Wealth Boom Signals New Growth Era!

- 12 Dec, 2025

- 2

Meesho IPO Oversubscribed 79×; QIB Demand Hits 120×!

- 06 Dec, 2025

- 2

8 Long-Term Stocks Favoured by Top Brokers!

- 23 Nov, 2025

- 2

₹90,000 Crore IPO Surge Sees Weak Listing Returns!

- 21 Nov, 2025

- 2

Categories

Recent News

Daily Newsletter

Get all the top stories from Blogs to keep track.