GST-Free Gene Therapy: A Game-Changer for Health

- ByPrachi Arora

- 18 Jan, 2025

- 0 Comments

- 1

India'ss healthcare landscape received a boost as the Central Board of Indirect Taxes and Customs (CBIC) announced the full exemption of Goods and Services Tax (GST) on gene therapy, effective January 16, 2025. Previously subject to a 12% GST, this exemption marks a significant reduction in the financial burden for patients relying on this advanced treatment for life-threatening conditions, including various types of blood cancers.

Gene therapy, particularly CAR-T cell therapy, has been transformative in treating cancers such as leukemia, lymphoma, and multiple myeloma. Its newfound affordability could extend its reach to a broader patient base, revolutionizing care for those battling these diseases.

The Union Budget 2025 is also expected to propose additional duty cuts on imported medicines targeting cancer and rare diseases. These reductions aim to alleviate the financial strain on patients and families, many of whom struggle with the exorbitant costs of specialized treatments. In alignment with these measures, the National Policy for Rare Diseases (NPRD) provides a roadmap for managing rare conditions, including Spinal Muscular Atrophy (SMA) and Pompe Disease.

Previously, the government exempted imported drugs for rare diseases listed under the NPRD from customs duties. This initiative reflects a broader push to make life-saving treatments more accessible, underscoring the government’s commitment to public health reforms.

Post a comment

Beat the heat with these 7 protein-packed curd lunches

- 17 Apr, 2025

- 3

‘I have a sad life’- What Happened To Sara Ali...

- 21 Feb, 2025

- 2

Ek aur type of diabetes? Type 5 ka sach finally...

- 17 Apr, 2025

- 3

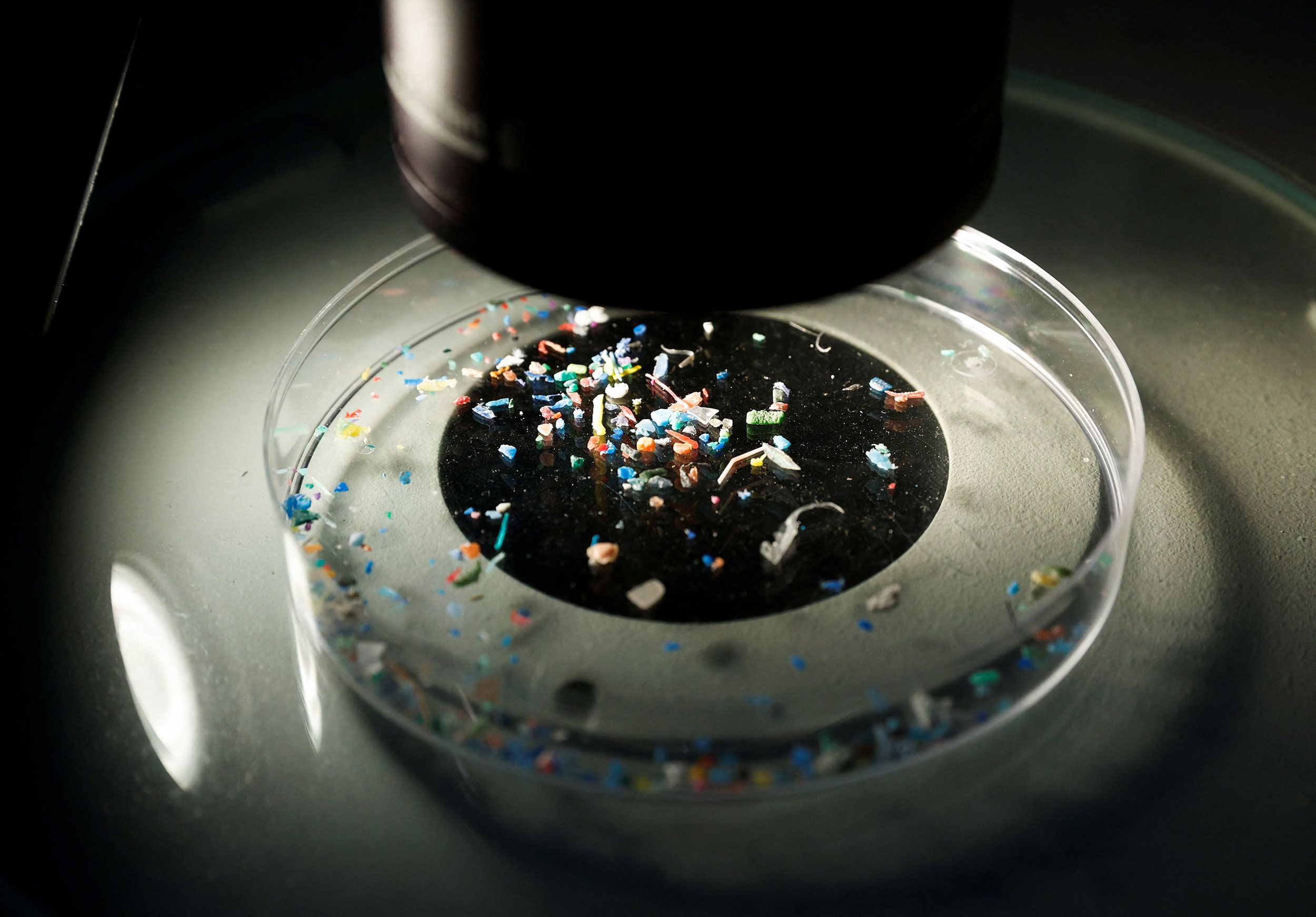

Scientists detect microplastics in human eggs—alarming fertility risk

- 20 Apr, 2025

- 3

Mulethi: Your natural remedy for cough, cold and ulcers

- 27 Dec, 2024

- 2

Categories

Recent News

Daily Newsletter

Get all the top stories from Blogs to keep track.